Getting The Mileage Tracker To Work

Table of ContentsThe Best Guide To Mileage TrackerAbout Mileage TrackerThe Of Mileage TrackerFascination About Mileage TrackerGetting The Mileage Tracker To WorkNot known Facts About Mileage Tracker

A web-based planner should have the ability to offer you a quite accurate price quote of gas mileage for the journey in question. While it might seem like a difficult task, the advantages of keeping an auto gas mileage log are incredible. When you enter into the practice of tracking your mileage, it will certainly become force of habit to you.

Ready to begin your efficiency journey? Look into our collection of notebooks!.?. !! Portage Notebooks lies in Northeast Ohio and has been developing expert notebooks for media, police, and services for over fifty years. Our notebooks are used the best materials. If you are interested in discovering more regarding productivity, time monitoring, or notebook company tips, see our blog. If you have any kind of questions, do not hesitate to connect - email us at!.

For local business proprietors, tracking gas mileage can be a laborious but vital job, specifically when it comes to optimizing tax obligation reductions and regulating overhead. The days of manually tape-recording mileage in a paper log are fading, as digital mileage logs have made the process a lot more effective, precise, and practical.

Indicators on Mileage Tracker You Should Know

Among the most significant advantages of making use of a digital mileage log is the moment it saves. With automation at its core, electronic tools can track your trips without calling for hands-on input for each trip you take. Digital gas mileage logs take advantage of GPS technology to instantly track the range traveled, classify the journey (e.g., company or individual), and produce comprehensive records.

The application does all the benefit you. Time-saving: Save hours of hand-operated information entry and prevent human mistakes by automating your gas mileage logging process. Real-time tracking: Promptly track your miles and generate reports without waiting up until completion of the week or month to log journeys. For small company proprietors, where time is cash, making use of a digital mileage log can substantially simplify day-to-day operations and liberate more time to focus on expanding business.

Some entrepreneur are unclear about the advantages of tracking their driving with a mileage app. The mileage tracker is a fantastic tool that offers several benefits. Download it here to find out more. Essentially, tracking mileage throughout organization traveling will help to boost your gas performance. It can likewise assist lessen vehicle damage.

6 Easy Facts About Mileage Tracker Explained

This write-up will disclose the advantages linked with leveraging a mileage tracker. If you run a distribution company, there is a high opportunity of spending lengthy hours on the road daily. Company owner commonly discover it hard to track the distances they cover with their lorries because they have a whole lot to consider.

In that case, it means you have all the opportunity to improve on that element of your company. When you utilize a mileage tracker, you'll be able to tape your expenses better (mileage tracker).

Gas mileage monitoring plays a big role in the lives of numerous motorists, staff members and business choice makers. It's a little, everyday thing that can have a huge impact on personal lives and bottom lines. What precisely is mileage tracking? What does gas mileage monitoring indicate? And what makes a mileage tracker app the most effective mileage tracker application? We'll damage down all of that and more in this post.

About Mileage Tracker

Gas mileage tracking, or gas mileage capture, is the recording of the miles your drive for company. There are a couple of reasons to do so. Prior to the TCJA, W-2 workers would certainly track miles for tax reduction. However, this is no more an option. Many permanent employees or agreement employees our website tape-record their gas mileage for reimbursement functions.

It's crucial to note that, while the tool utilizes GPS and motion sensing unit abilities of the phone, they aren't sharing locations with companies in real time - mileage tracker. This isn't a surveillance initiative, however a more hassle-free method to capture business trips took a trip precisely. A free gas mileage capture app will certainly be difficult ahead by

The Mileage Tracker PDFs

Mileage applications for individual motorists can set you back anywhere from $3 to $30 a month. Our team has years of experience with gas mileage capture. One point we do not provide is a single-user gas mileage application. We recognize there are a great deal of employees around that need an application to track their gas mileage for tax obligation and reimbursement functions.

There are a substantial number of advantages to making use of a gas mileage tracker. Let's explore these benefits further, starting with one of the most vital reasons to execute a mileage monitoring application: Internal revenue service compliance.

Expenditure repayment scams represent 17% of overhead fraud. Oftentimes, that fraudulence is straight associated with T&E items. Many firms are simply unaware of the fraud due to the fact that their procedures are not able to check records in an automated, effective style. With a computerized mileage tracking app, business receive GPS-verified gas mileage logs from their workers.

Excitement About Mileage Tracker

A good mileage monitoring application offers all the above. useful source The best comes with a group liable for gathering the mileage details, taking care of repayments and supplying understandings right into your workforce. Automating mileage monitoring enhances performance for those in the field and those busy submitting the logs. With a mileage app, logs can quickly be sent for repayment and free up the administrative work of confirming all staff member gas mileage logs.

Again, specialists generally make use of organization gas mileage trackers to maintain track of their gas mileage for tax obligation reductions. However some gas mileage trackers are much better than others. What makes the very best mileage tracker app? Below are a couple of means that particular applications establish themselves above the rest. Automated mileage navigate to this site monitoring advantages the business and its workers in various ways.

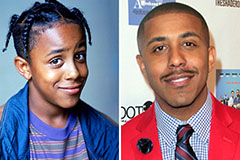

Brandy Then & Now!

Brandy Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now!